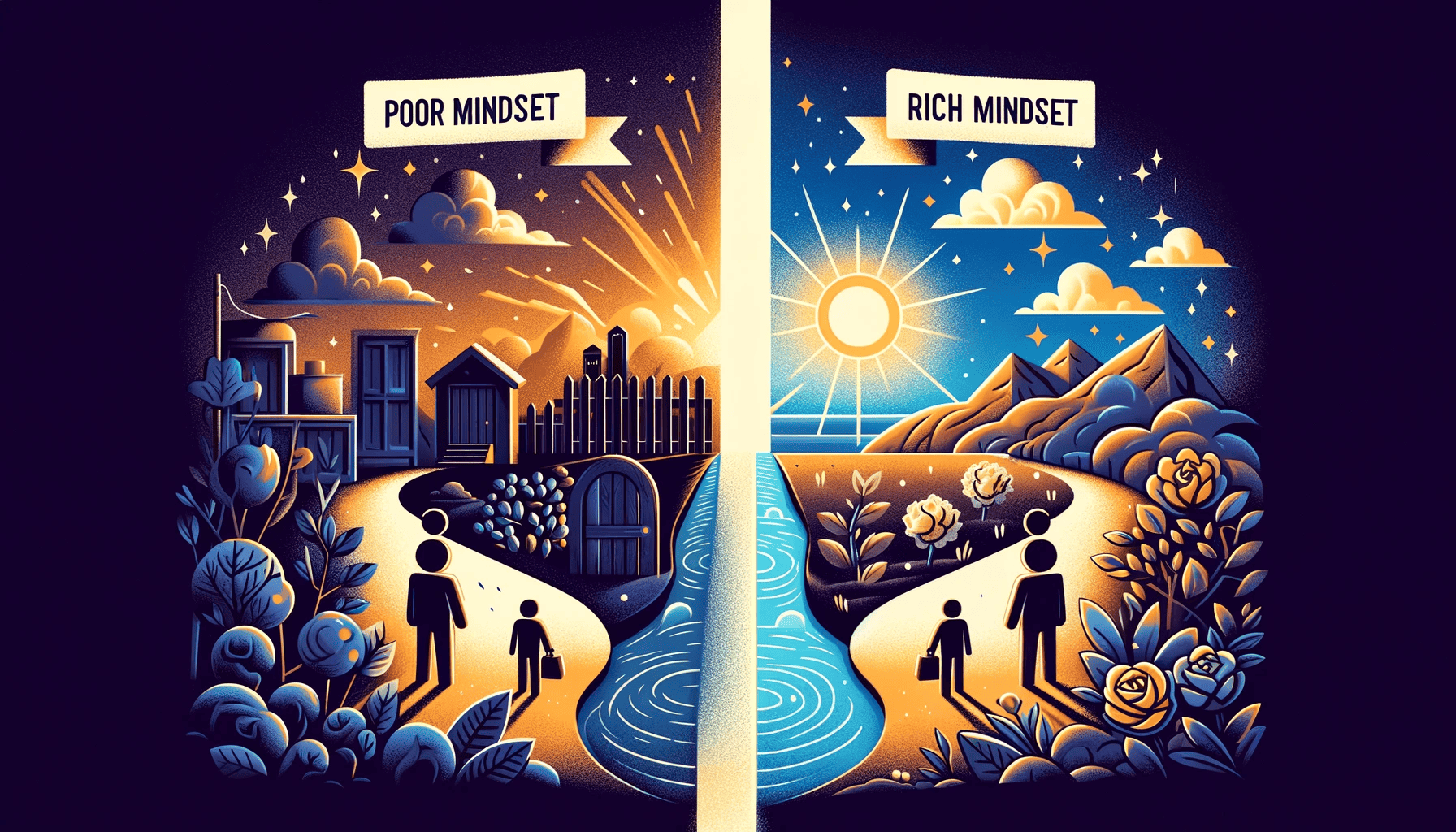

Hello everyone, today we’ll be exploring the key and the main differences between the Rich Mindset and Poor Mindset People.

After reading this article, You’ll be able to think like a Rich People and take a step ahead on completing your dream goals.

This article is based on “Rich Dad Poor Dad” by Robert Kiyosaki.

1. Attitude Towards Money and Wealth.

The single most important financial rule mentioned by Kiyosaki in his book is understanding the difference between an asset – something that puts money in your pocket – and a liability – something that takes money out of your pocket.

The wealthy focuses on acquiring income generating assets, while the poor and middle class often spend money on liabilities, which they confuses as assets.

A common mistake among poor mindset is focusing on acquiring material possessions, such as flashy cars, designer clothes, and ostentatious homes, rather than investing in assets that generate long-term wealth.

By prioritizing education, investments, businesses, and intellectual property, one can steadily build their financial prosperity. Without grasping this fundamental difference between assets and liabilities, you may find yourself stuck on a never-ending “financial treadmill,” unable to make any significant progress.

2. Approach to Risk and Investment:

In “Rich Dad Poor Dad”, Kiyosaki presents contrasting view on risk and investment.

In the book he refers to an Poor Dad, representing a Poor mindset people, who advise a conventional path towards financial security and Rich Dad, representing a Rich mindset people who advocates for a bolder approach to wealth creation.

Poor Dad recommended studying hard to secure employment with a reputable company. This advice stems from a risk-averse perspective, where the primary goal is to attain a stable income and avoid financial risks. This mindset prioritizes job security over potential financial growth and tends to shy away from investments that carry any level of uncertainty.

On the other hand, Rich Dad encouraged studying not to find a good job, but to acquire companies – an attitude that embraces financial risks as opportunities for substantial growth. This mindset views money as a tool to create more wealth. He believed that learning to manage risk, rather than avoiding it, is crucial for financial success.

Leave a Reply